AI-Powered Credit Card Recommendation System with OpenAI GPT, Telegram & Google Sheets

Last edited 115 days ago

Overview

Confused which credit card to actually get or swipe? With 100+ cards in the market, hidden caps, and milestone rules, most people end up leaving rewards, perks, and cashback on the table.

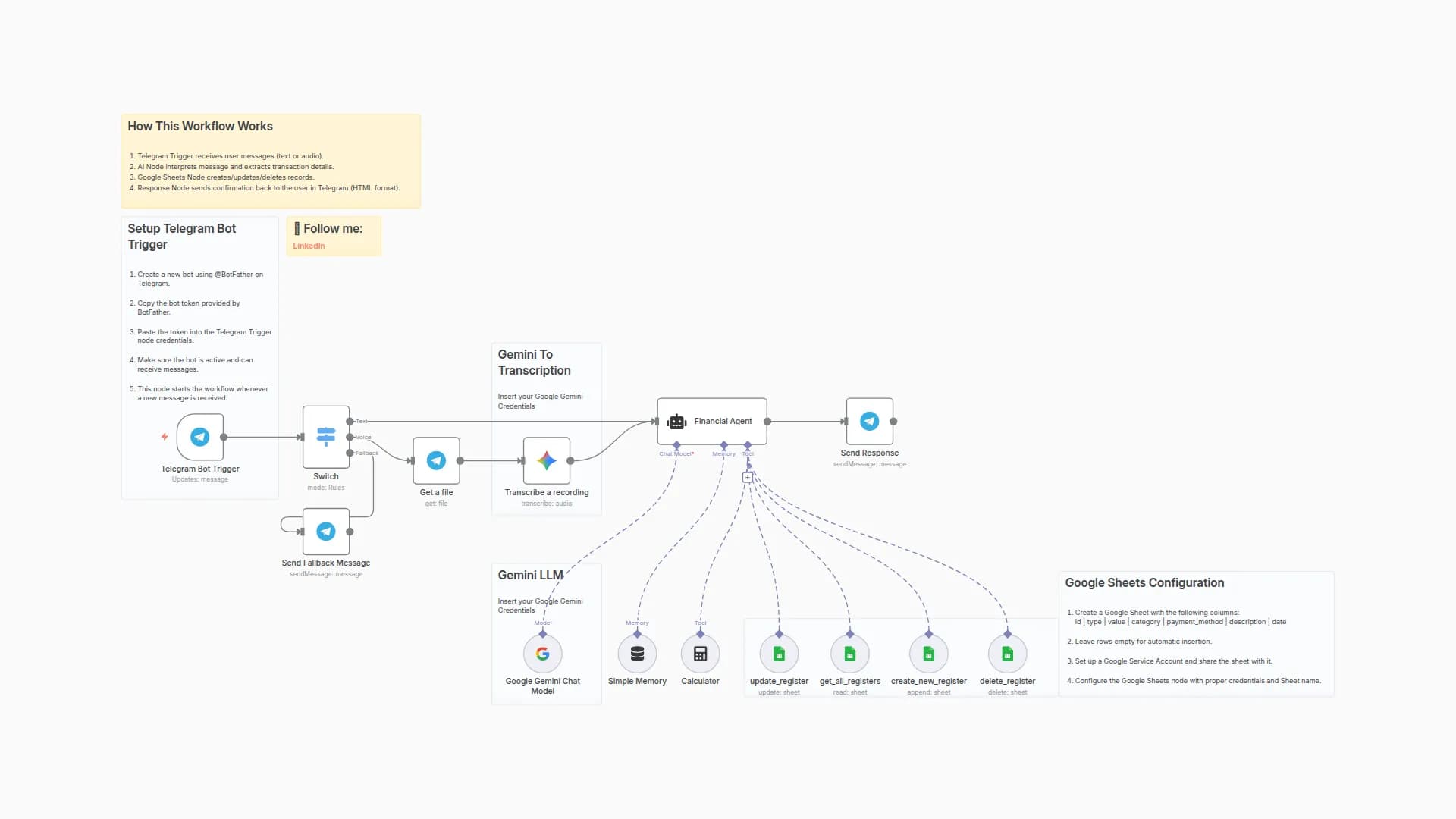

This workflow uses n8n + GPT + Google Sheets + Telegram to recommend the best credit card for each user’s lifestyle in under 3 seconds, while keeping the logic transparent with a ₹-value breakdown.

What does this workflow do?

This workflow:

Captures User Inputs – Users answer a 7-question lifestyle quiz via Telegram.

Stores Responses – Google Sheets logs all answers for resumption & deduplication.

Scores Answers – n8n Function nodes map single & multi-select inputs into scores.

Generates Recommendations – GPT analyses profile vs. 30+ card dataset.

Breaks Down Value – Outputs a transparent table of rewards, milestones, lounge value.

Delivers Results – Top 3 card picks returned instantly on Telegram.

Why is this useful?

Most card comparison tools only list features — they don’t personalise or calculate actual value. This workflow builds a decision engine:

🔍 Personalised → matches lifestyle to best-fit cards

💸 Transparent → shows value in real currency (rewards, milestones, lounges)

⏱ Fast → answers in under 3 seconds

🗂 Organised → Google Sheets keeps audit trail of every user + dedupe

Tools used

n8n (Orchestrator): Orchestration + logic branching

Telegram: User-facing quiz bot

Google Sheets: Database of credit cards + logs of user answers

OpenAI (GPT): Analyses user profile & generates recommendations

Who is this for?

🧑💻 Fintech product builders → see how AI can power recommendation engines

💳 Cardholders → understand which card fits their lifestyle best

⚙️ n8n makers → learn how to combine Sheets + GPT + chat interface into one workflow

🌍 How to adapt it for your country/location

This workflow uses a credit card dataset stored in Google Sheets. To make it work for your country:

Build your dataset → scrape or collect card details from banks, comparison sites, or official portals

Fields to include: Fees, Reward rate, Lounge access, Forex markup, Reward caps, Milestones, Eligibility.

You can use web crawlers (e.g., Apify, PhantomBuster) to automate data collection.

Update the Google Sheet → replace the India dataset with your country’s cards.

Adjust scoring logic → modify Function nodes if your cards use different reward structures (e.g., cashback %, miles, points value).

Run the workflow → GPT will analyse against the new dataset and generate recommendations specific to your country.

This makes the workflow flexible for any geography.

Workflow Highlights

✅ End-to-end credit card recommendation pipeline (quiz → scoring → GPT → result)

✅ Handles single + multi-select inputs fairly with % match scoring

✅ Transparent value breakdown in local currency (rewards, milestones, lounge access)

✅ Google Sheets for persistence, dedupe & audit trail

✅ Delivers top 3 cards in <3 seconds on Telegram

✅ Fully customisable for any country by swapping the dataset

You may also like

New to n8n?

Need help building new n8n workflows? Process automation for you or your company will save you time and money, and it's completely free!