Automate Financial Operations with O3 CFO & GPT-4.1-mini Finance Team

Last edited 115 days ago

Automate Financial Operations with O3 CFO & GPT-4.1-mini Finance Team

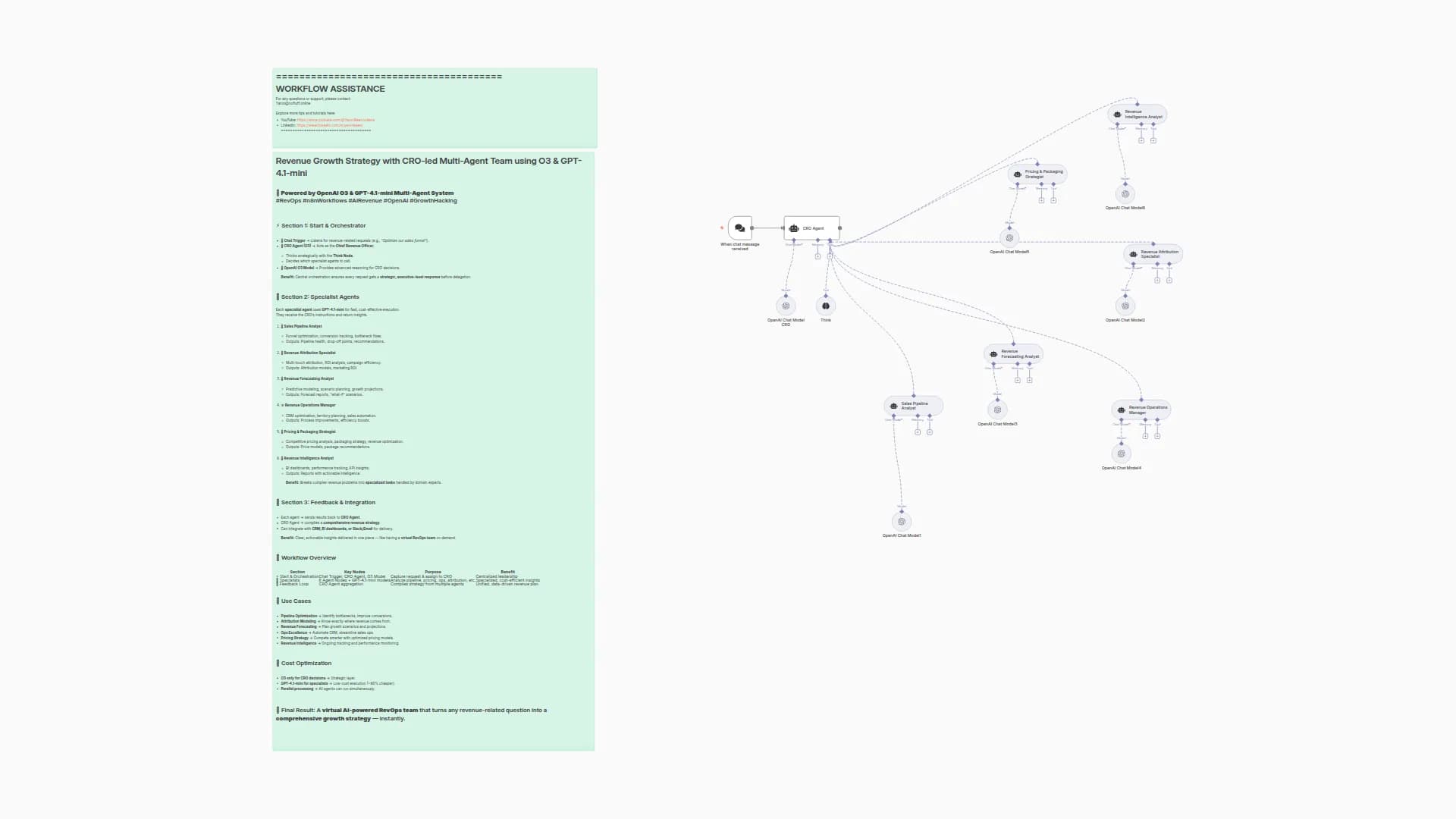

This workflow builds a virtual finance department inside n8n. At the center is a CFO Agent (O3 model) who acts like a strategic leader. When a financial request comes in, the CFO interprets it, decides the strategy, and delegates to the specialist agents (each powered by GPT-4.1-mini for cost efficiency).

🟢 Section 1 – Entry & Leadership

Nodes:

- 💬 When chat message received → Entry point for user financial requests.

- 💼 CFO Agent (O3) → Acts as the Chief Financial Officer. Interprets the request, decides the approach, and delegates tasks.

- 💡 Think Tool → Helps the CFO brainstorm and refine financial strategies.

- 🧠 OpenAI Chat Model CFO (O3) → High-level reasoning engine for strategic leadership.

✅ Beginner view: Think of this as your finance CEO’s desk — requests land here, the CFO figures out what needs to be done, and the right specialists are assigned.

📊 Section 2 – Specialist Finance Agents

Each specialist is powered by GPT-4.1-mini (fast + cost-effective).

- 📈 Financial Planning Analyst → Builds budgets, forecasts, and financial models.

- 📚 Accounting Specialist → Handles bookkeeping, tax prep, and compliance.

- 🏦 Treasury & Cash Management Specialist → Manages liquidity, banking, and cash flow.

- 📊 Financial Analyst → Runs KPI tracking, performance metrics, variance analysis.

- 💼 Investment & Risk Analyst → Performs investment evaluations, capital allocation, and risk management.

- 🔍 Internal Audit & Controls Specialist → Checks compliance, internal controls, and audits.

✅ Beginner view: This section is your finance department — every role you’d find in a real company, automated by AI.

📋 Section 3 – Flow of Execution

- User sends a request (e.g., “Create a financial forecast for Q1 2026”).

- CFO Agent (O3) interprets it → “We need planning, analysis, and treasury.”

- Delegates tasks to the relevant specialists.

- Specialists process in parallel, generating plans, numbers, and insights.

- CFO Agent compiles and returns a comprehensive financial report.

✅ Beginner view: The CFO is the conductor, and the specialists are the musicians. Together, they produce the financial “symphony.”

📊 Summary Table

Section

Key Roles

Model

Purpose

Beginner Benefit

🟢 Entry & Leadership

CFO Agent, Think Tool

O3

Strategic direction

Acts like a real CFO

📊 Finance Specialists

FP Analyst, Accounting, Treasury, FA, Investment, Audit

GPT-4.1-mini

Specialized tasks

Each agent = finance department role

📋 Execution Flow

All connected

O3 + GPT-4.1-mini

Collaboration

Output = complete financial management

🌟 Why This Workflow Rocks

- Full finance department in n8n

- Strategic + execution separation → O3 for CFO, GPT-4.1-mini for team

- Cost-optimized → Heavy lifting done by mini models

- Scalable → Easily add more finance roles (tax, payroll, compliance, etc.)

- Practical outputs → Reports, budgets, risk analyses, audit notes

👉 Example Use Case:

“Generate a Q1 financial forecast with cash flow analysis and risk report.”

- CFO reviews request.

- Financial Planning Analyst → Budget + Forecast.

- Treasury Specialist → Cash flow modeling.

- Investment Analyst → Risk review.

- Audit Specialist → Compliance check.

- CFO delivers a packaged financial report back to you.

You may also like

New to n8n?

Need help building new n8n workflows? Process automation for you or your company will save you time and money, and it's completely free!